Gold has long been a symbol of wealth and stability, cherished for its intrinsic value and historical significance. Among the various forms of gold investment, bullion bars are a popular choice for both novice and seasoned investors. This article delves into the world of bullion bars, exploring their benefits, types, and practical tips for making informed investment decisions.

What Are Bullion Bars?

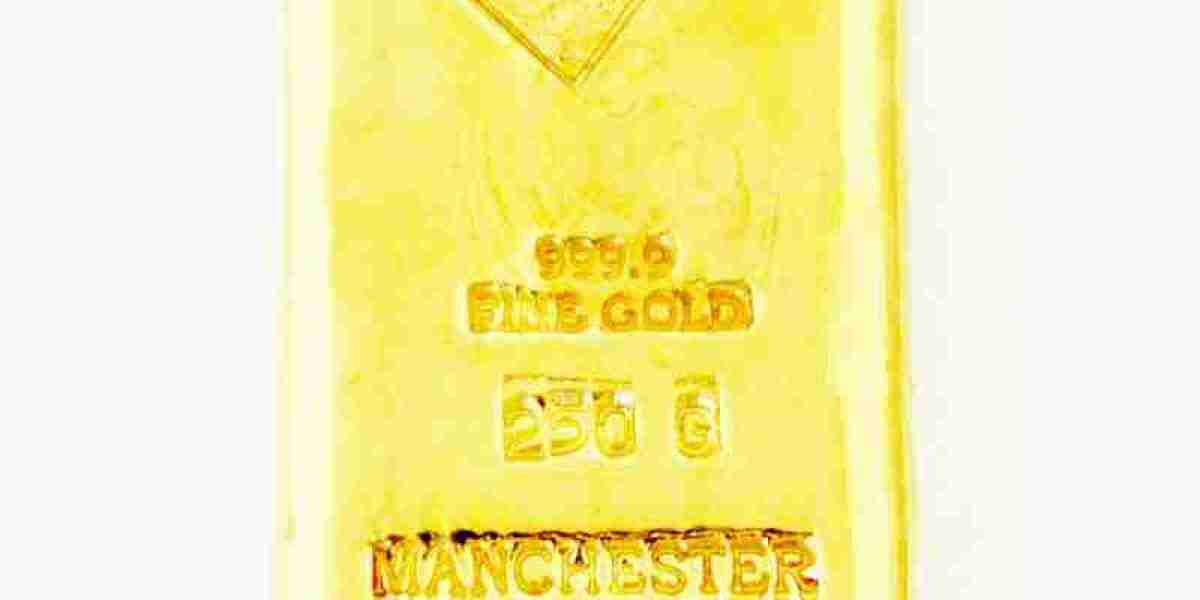

Bullion bars, often simply referred to as gold bars, are a form of gold investment that comes in various sizes and weights. These bars are typically made of high-purity gold, with a standard of 99.99% (24 karats). Bullion bars are produced by recognized mints and refineries and are stamped with details such as weight, purity, and the manufacturer's mark.

Benefits of Investing in Bullion Bars

Tangible Asset: Unlike stocks or bonds, gold bars are physical assets that you can hold. This tangibility provides a sense of security and ownership.

Intrinsic Value: Gold has intrinsic value, which means its worth is inherent and not dependent on any government or financial institution.

Hedge Against Inflation: Gold is known for being a reliable hedge against inflation. When currency values fall, the price of gold often rises, protecting your purchasing power.

High Liquidity: Bullion bars are highly liquid and can be easily bought or sold in various markets around the world. This makes them a versatile addition to any investment portfolio.

Portfolio Diversification: Adding gold to your investment portfolio can reduce risk and volatility, as gold often performs well during economic downturns when other assets might struggle.

Types of Bullion Bars

Cast Bars: These bars are made by pouring molten gold into molds. They tend to have a rougher finish and are often less expensive due to their simpler manufacturing process.

Minted Bars: Minted bars are cut from a rolled strip of gold and have a polished finish with precise dimensions. They usually come with intricate designs and are packaged in tamper-evident packaging.

Commemorative Bars: These bars are issued to mark special events or anniversaries. They may carry a premium over their melt value due to their collectible nature.

Popular Bullion Bar Sizes

1g to 10g Bars: These smaller bars are affordable and popular among new investors. They are easy to store and trade, making them an excellent starting point for gold investment.

1oz Bars: Weighing approximately 31.1 grams, 1oz bars are bullion bars a common choice for investors seeking a balance between size and value.

100g to 1kg Bars: These larger bars are favored by serious investors and institutions. They offer lower premiums per gram and are efficient for storing significant amounts of wealth.

Key Considerations When Buying Bullion Bars

Purity and Manufacturer: Ensure that the bullion bars are of high purity, ideally 99.99%. Buy bars from reputable manufacturers like PAMP Suisse, Perth Mint, and Valcambi, which are recognized worldwide for their quality.

Certification and Authenticity: Always purchase bullion bars that come with a certificate of authenticity. This certificate includes important details such as weight, purity, and a unique serial number.

Dealer Reputation: Choose a reputable dealer with a strong track record. Look for dealers who are members of industry associations such as the London Bullion Market Association (LBMA).

Price and Premiums: The price of bullion bars is influenced by the current spot price of gold, plus a premium. Compare premiums from different dealers to ensure you get the best deal. Be cautious of deals that seem too good to be true.

Storage and Insurance: Proper storage is essential to protect your investment. Options include home safes, bank deposit boxes, or professional bullion storage services. Insuring your bullion bars provides additional protection against theft or loss.

How to Buy Bullion Bars

Research and Planning: Start by researching the current gold market and determining your investment goals. Decide how much you want to invest and what type and size of bullion bars suit your strategy.

Choose a Reputable Dealer: Select a dealer known for selling genuine and high-quality gold products. Check customer reviews and industry certifications to ensure reliability.

Verify the Product: Ensure that the bullion bars come with proper certification and are produced by a recognized manufacturer. Check for authenticity marks, such as the manufacturer's hallmark and serial number.

Secure Payment and Delivery: Use secure payment methods and ensure the dealer offers insured shipping. Upon receiving your bullion bars, verify their condition and authenticity immediately.

Storage and Maintenance: Store your bullion bars in a secure location. Consider professional storage services for added security. Regularly check the condition of your gold and keep it insured.

Conclusion

Bullion bars represent a solid and enduring investment in the world of precious metals. Their intrinsic value, high liquidity, and role as a hedge against economic uncertainty make them a prudent choice for investors seeking stability and diversification. By understanding the benefits, types, and key considerations, and by following best practices for purchasing and storing bullion bars, you can make informed decisions that will help secure your financial future. Whether you're a new investor or looking to expand your portfolio, bullion bars offer a robust and reliable investment opportunity.